Proven Wealth Building Strategies for Financial Freedom

Introduction & Overview: Unlocking the Secrets of Wealth BuildingWealth building is the process of accumulating and growing your financial assets

Introduction & Overview: Unlocking the Secrets of Wealth Building

Wealth building is the process of accumulating and growing your financial assets over time to achieve financial independence and security. Whether your goal is to become a millionaire, retire comfortably, or simply have more control over your financial future, implementing the right wealth building strategies can make all the difference. In this comprehensive guide, we'll explore the key principles, proven techniques, and essential tools needed to start your journey towards lasting wealth and prosperity.

By the end of this article, you'll have a deep understanding of the different wealth building approaches, step-by-step implementation methods, and advanced strategies used by financial experts and successful individuals. Armed with this knowledge, you'll be well on your way to taking control of your financial destiny and building the wealth you deserve.

Background & History: The Evolution of Wealth Building

The concept of wealth building has been around for centuries, with roots tracing back to ancient civilizations and the earliest forms of trade and commerce. Throughout history, individuals, families, and societies have sought ways to accumulate, preserve, and grow their financial assets to ensure long-term stability and prosperity.

In the modern era, the principles of wealth building have evolved significantly, influenced by economic theories, technological advancements, and the changing financial landscape. From the rise of investment vehicles like stocks, bonds, and real estate to the emergence of personal finance tools and online banking, the ways in which people can build wealth have become increasingly diverse and accessible.

Today, wealth building is a crucial aspect of personal and financial planning, with a wide range of strategies and approaches available to suit the unique goals and circumstances of individuals. Whether you're just starting your career, nearing retirement, or somewhere in between, understanding the historical context and current trends in wealth building can provide valuable insights and guidance on your path to financial freedom.

Types & Categories of Wealth Building Strategies

When it comes to wealth building, there is no one-size-fits-all approach. The specific strategies and techniques you choose will depend on your financial goals, risk tolerance, time horizon, and personal preferences. Here are some of the most common types and categories of wealth building strategies:

Passive Income Streams

Passive income refers to money that you earn without actively trading your time for it. This can include rental income from real estate, dividends from investments, royalties from creative works, and income from online businesses or affiliate marketing. By building multiple passive income streams, you can create a steady flow of cash that compounds over time, allowing your wealth to grow even when you're not actively working.

Investing and Asset Allocation

Investing in a diversified portfolio of assets, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs), is a core wealth building strategy. By allocating your investments across different asset classes, you can manage risk, take advantage of market opportunities, and potentially achieve higher long-term returns. This approach requires careful research, portfolio management, and a long-term investment horizon.

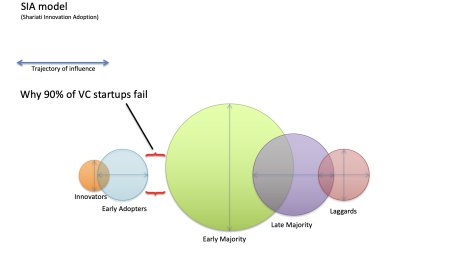

Entrepreneurship and Business Ownership

Starting and growing your own business can be a powerful wealth building strategy. Entrepreneurs have the opportunity to create value, generate income, and potentially build significant equity in their company. This path often involves higher risk but can also lead to greater rewards, particularly for those with a strong business acumen, innovative ideas, and the drive to succeed.

Real Estate Investing

Investing in real estate, whether through the purchase of rental properties, real estate investment trusts (REITs), or crowdfunded real estate platforms, can be a reliable way to build wealth. Real estate can provide a steady stream of rental income, potential appreciation in property values, and tax benefits, making it a popular choice for many wealth-building enthusiasts.

Retirement Accounts and Tax-Advantaged Savings

Maximizing contributions to retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, can be a powerful wealth building strategy. These accounts offer tax-deferred or tax-free growth, allowing your investments to compound over time. Additionally, leveraging other tax-advantaged savings vehicles, like health savings accounts (HSAs) and 529 college savings plans, can help you build wealth while minimizing your tax burden.

Debt Management and Elimination

Effectively managing and eliminating debt is a crucial component of wealth building. High-interest debt, such as credit card balances, can erode your financial progress, while low-interest debt, like mortgages or student loans, can be leveraged as part of a broader wealth building strategy. Strategies like debt consolidation, balance transfer cards, and aggressive debt repayment can help you become debt-free and free up resources for investment and savings.

Detailed How-To: Implementing Wealth Building Strategies

Now that you have a solid understanding of the different types of wealth building strategies, let's dive into the practical implementation steps. Remember, the specific approach you choose will depend on your unique financial situation, goals, and risk tolerance, so it's essential to carefully evaluate and tailor the strategies to your individual needs.

Step 1: Assess Your Current Financial Situation

The first step in building wealth is to thoroughly understand your current financial standing. This includes reviewing your income, expenses, assets, and liabilities. Create a detailed budget, track your spending, and identify areas where you can cut costs or increase your savings. Understanding your starting point will help you set realistic goals and develop a customized wealth building plan.

Step 2: Establish Clear Financial Goals

Once you have a clear picture of your current financial situation, it's time to set specific, measurable, and achievable financial goals. These goals may include building an emergency fund, paying off debt, saving for a down payment on a home, or reaching a target net worth. By having a clear vision of what you want to accomplish, you can create a roadmap to guide your wealth building efforts.

Step 3: Diversify Your Income Streams

Relying solely on a single source of income can make it challenging to build wealth. Consider exploring ways to diversify your income, such as starting a side business, freelancing, or investing in passive income-generating assets. Diversifying your income sources can help you weather economic fluctuations and create multiple avenues for wealth accumulation.

Step 4: Prioritize Debt Elimination

High-interest debt, such as credit card balances, can be a significant obstacle to wealth building. Develop a strategic plan to pay off your debts, starting with the highest-interest obligations first. This may involve techniques like debt consolidation, balance transfers, or the debt snowball method. By becoming debt-free, you'll free up resources that can be redirected towards investment and savings.

Step 5: Maximize Retirement Contributions

Contribute as much as you can to tax-advantaged retirement accounts, such as 401(k)s, IRAs, and Roth IRAs. These accounts offer the benefits of tax-deferred or tax-free growth, allowing your investments to compound over time. If your employer offers matching contributions, be sure to take full advantage of this free money to boost your retirement savings.

Step 6: Invest in a Diversified Portfolio

Investing in a well-diversified portfolio of assets, including stocks, bonds, mutual funds, and ETFs, can be a powerful wealth building strategy. Allocate your investments across different asset classes to manage risk and potentially achieve higher long-term returns. Consider working with a financial advisor or using robo-advisors to help you create and manage your investment portfolio.

Step 7: Explore Real Estate Investing

Investing in real estate can be a lucrative way to build wealth. This can include purchasing rental properties, investing in REITs, or participating in real estate crowdfunding platforms. Real estate can provide a steady stream of rental income, potential appreciation in property values, and tax benefits. However, it's essential to thoroughly research and understand the risks and responsibilities associated with real estate investing.

Step 8: Continuously Educate Yourself

Wealth building is an ongoing process that requires a commitment to continuous learning and self-improvement. Stay up-to-date on financial trends, investment strategies, and personal finance best practices by reading books, listening to podcasts, and attending workshops or seminars. The more you educate yourself, the better equipped you'll be to make informed decisions and adapt to changing financial landscapes.

Tools & Resources for Wealth Building

To support your wealth building journey, there are a variety of tools and resources available, both free and paid. Here are some of the most useful options to consider:

Personal Finance Apps and Budgeting Tools

Apps like Mint, YNAB (You Need a Budget), and Personal Capital can help you track your spending, create budgets, and monitor your overall financial health. These tools can provide valuable insights and automation to streamline your wealth building efforts.

Investment Platforms and Robo-Advisors

Online investment platforms, such as Vanguard, Fidelity, and Schwab, offer a wide range of investment options, research tools, and educational resources to help you build and manage your investment portfolio. Robo-advisors, like Betterment and Wealthfront, provide automated, algorithm-driven investment management services, making it easier for beginners to get started with investing.

Real Estate Investment Platforms

Websites like Fundrise, Crowdstreet, and Realty Mogul allow you to invest in real estate projects and properties through crowdfunding or direct investment opportunities. These platforms can provide access to a diversified real estate portfolio without the hands-on management required with traditional rental properties.

Personal Finance Blogs and Podcasts

Staying informed and inspired through personal finance blogs and podcasts can be a valuable resource for wealth building. Some popular options include The Simple Dollar, The Financial Diet, The Ramsey Show, and The Money Guy Show, which offer a wealth of information, tips, and strategies for building and managing your wealth.

Financial Advisors and Planners

For those seeking more personalized guidance, working with a qualified financial advisor or planner can be a worthwhile investment. These professionals can help you develop a comprehensive wealth building plan, provide investment management services, and offer tax and estate planning advice tailored to your specific needs.

Advanced Wealth Building Strategies

As you progress on your wealth building journey, you may want to explore more advanced strategies to further optimize your financial growth. Here are some expert-level techniques to consider:

Tax Minimization Strategies

Implementing tax-efficient strategies, such as maximizing contributions to tax-advantaged accounts, utilizing tax-loss harvesting, and taking advantage of deductions and credits, can help you retain more of your hard-earned wealth. Consulting with a tax professional can be beneficial in identifying and implementing these advanced tax-saving techniques.

Alternative Investments

Diversifying beyond traditional asset classes, such as stocks and bonds, can provide additional opportunities for wealth building. This may include investing in alternative assets like private equity, venture capital, hedge funds, or even alternative energy projects. These investments often come with higher risk but can also offer the potential for higher returns.

Passive Income Optimization

Continuously exploring and implementing new passive income streams can accelerate your wealth building efforts. This may involve scaling your existing businesses, expanding your real estate portfolio, or exploring emerging opportunities in the digital economy, such as e-commerce, affiliate marketing, or online content creation.

Estate Planning and Wealth Transfer

As your wealth grows, it's essential to consider estate planning strategies to protect your assets and ensure a smooth transfer of wealth to your beneficiaries. This may include setting up trusts, drafting wills, and implementing tax-efficient strategies to minimize the impact of estate taxes on your legacy.

Philanthropic Giving and Impact Investing

Many successful individuals choose to allocate a portion of their wealth towards philanthropic causes or impact investing initiatives that align with their values and beliefs. This not only allows you to make a positive difference in the world but can also provide tax benefits and a sense of purpose that can enhance your overall wealth building journey.

Conclusion: Embracing the Wealth Building Mindset

Wealth building is a multifaceted and dynamic process that requires a combination of strategic planning, disciplined execution, and a long-term mindset. By understanding the different wealth building strategies, implementing a customized approach, and continuously educating yourself, you can take control of your financial future and build the wealth you deserve.

Remember, the path to wealth is not always linear, and there may be setbacks and challenges along the way. However, by staying focused, adaptable, and committed to your goals, you can overcome obstacles and make steady progress towards financial freedom. Embrace the wealth building mindset, take action, and start your journey towards a more prosperous and secure future today.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0