Early-stage Startup Funding: A Comprehensive Guide to

Early-stage Startup Funding: A Comprehensive Guide to Securing Investments As an entrepreneur, securing early-stage funding for your startup is a

Early-stage Startup Funding: A Comprehensive Guide to Securing Investments

As an entrepreneur, securing early-stage funding for your startup is a critical step in turning your vision into a reality. Whether you're just starting out or looking to scale your business, navigating the complex world of startup financing can be a daunting task. In this comprehensive guide, we'll explore the various funding options available, share proven strategies for attracting investors, and provide you with the tools and insights you need to successfully secure the capital your business requires.

Understanding the Landscape of Early-stage Startup Funding

The world of early-stage startup funding is diverse and ever-evolving, with a range of financing options to consider. From traditional sources like angel investors and venture capitalists to alternative avenues like crowdfunding and government grants, each option presents its own set of advantages and challenges. Let's dive into the key players and funding mechanisms that shape the early-stage startup ecosystem:

1. Angel Investors

Angel investors are high-net-worth individuals who provide capital to startups in exchange for equity or convertible debt. These investors are often experienced entrepreneurs or industry experts who are looking to invest in promising early-stage companies. Angel investors typically invest smaller amounts, ranging from $25,000 to $1 million, and may offer valuable mentorship and guidance in addition to their financial support.

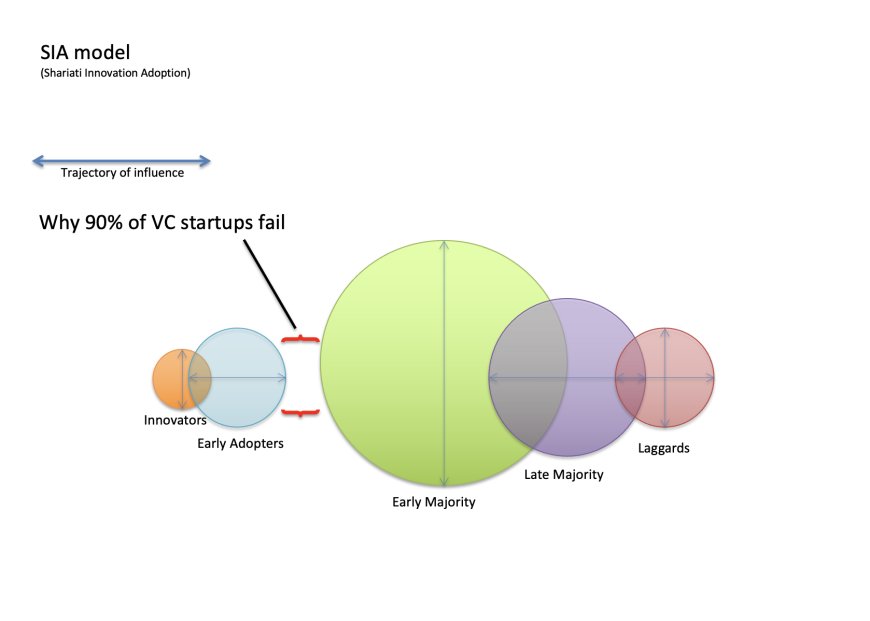

2. Venture Capitalists (VCs)

Venture capitalists are professional investment firms that pool money from various sources, such as institutional investors and high-net-worth individuals, to invest in startups with high growth potential. VCs typically invest larger sums, ranging from $1 million to $10 million or more, and often take an active role in the companies they invest in, providing strategic advice and connections. However, the competition for VC funding is fierce, and the selection process can be rigorous.

3. Crowdfunding

Crowdfunding platforms like Kickstarter, Indiegogo, and Crowdrise have become increasingly popular funding sources for early-stage startups. These platforms allow entrepreneurs to raise funds from a large number of individual backers, often in exchange for rewards or equity in the company. Crowdfunding can be an effective way to validate your business idea, build a community of supporters, and generate initial funding without giving up a significant equity stake.

4. Incubators and Accelerators

Incubators and accelerators are programs that provide early-stage startups with a range of resources, including workspace, mentorship, and access to a network of investors and industry experts. These programs often offer small amounts of seed funding, typically in the range of $20,000 to $150,000, in exchange for equity. Participating in an incubator or accelerator can be a valuable way to refine your business model, validate your idea, and gain exposure to potential investors.

5. Government Grants and Funding Programs

Many governments around the world offer grant programs and funding initiatives to support the growth of early-stage startups. These programs can provide non-dilutive funding, meaning you don't have to give up equity in your company. Examples include the Small Business Innovation Research (SBIR) program in the United States, Horizon Europe in the European Union, and the Startup India program in India. Researching and applying for relevant government funding can be a valuable source of capital for your startup.

Crafting a Winning Pitch: Strategies for Attracting Investors

Once you've explored the various funding options available, the next step is to craft a compelling pitch that will capture the attention of investors. Effective pitching is a critical skill for early-stage entrepreneurs, as it can make the difference between securing the funding you need and missing out on valuable opportunities. Here are some strategies to help you develop a winning pitch:

1. Understand Your Audience

Before you start crafting your pitch, it's essential to research and understand the investors you'll be presenting to. Different types of investors, such as angel investors and venture capitalists, may have varying investment criteria, risk appetites, and industry preferences. Tailor your pitch to address the specific needs and interests of your target audience, highlighting the aspects of your business that will be most appealing to them.

2. Develop a Compelling Narrative

Investors aren't just looking for numbers and financial projections; they want to hear a compelling story that captures the vision, mission, and potential of your startup. Craft a narrative that clearly and passionately communicates the problem your business is solving, the unique value proposition you offer, and the growth potential of your company. Use storytelling techniques to engage your audience and make a lasting impression.

3. Highlight Your Competitive Advantage

In a crowded startup landscape, it's crucial to demonstrate how your business stands out from the competition. Clearly articulate your unique selling points, whether it's a proprietary technology, a differentiated business model, or a talented and experienced team. Investors want to see that you have a sustainable competitive advantage that will enable your startup to thrive in the market.

4. Provide Concrete Evidence of Traction

Investors are looking for startups that have already gained some traction and validated their business model. Showcase your key performance indicators (KPIs), such as user growth, revenue, customer retention, or strategic partnerships, to demonstrate that your startup is gaining momentum and has the potential for continued success.

5. Outline a Clear and Realistic Plan

Investors want to see that you have a well-thought-out plan for how you intend to use their capital to grow your business. Provide a detailed roadmap that outlines your short-term and long-term goals, your marketing and sales strategies, your financial projections, and your plans for scaling the business. Demonstrate that you have a clear vision and the ability to execute it effectively.

6. Practice, Practice, Practice

Delivering a polished and confident pitch is crucial when seeking early-stage funding. Practice your pitch repeatedly, refining it based on feedback and adjusting your delivery to ensure that you come across as poised, knowledgeable, and enthusiastic about your startup. Consider conducting mock pitches with friends, colleagues, or mentors to get valuable feedback and improve your presentation skills.

Case Studies: Successful Early-stage Startup Funding Strategies

To further illustrate the principles of effective early-stage startup funding, let's explore a few real-world case studies of startups that have successfully secured investments:

Case Study 1: Airbnb

Airbnb, the popular home-sharing platform, is a prime example of a startup that leveraged a combination of funding sources to fuel its early-stage growth. In 2008, the founders, Brian Chesky and Joe Gebbia, initially bootstrapped the business by selling custom cereal boxes at a design conference. They then turned to crowdfunding, launching a successful campaign on Kickstarter that raised $30,000 to help them attend a key industry event. This early validation and momentum helped Airbnb attract angel investors, who provided the company with $600,000 in seed funding. Over the next few years, Airbnb went on to raise several rounds of venture capital, ultimately becoming a multi-billion-dollar company and a household name in the sharing economy.

Case Study 2: Dropbox

Dropbox, the cloud storage and file-sharing service, is another success story in early-stage startup funding. In 2007, the company's founder, Drew Houston, initially self-funded the business, investing his own savings to develop the initial product. He then turned to the startup accelerator Y Combinator, which provided him with $15,000 in seed funding and valuable mentorship. This early investment and validation from a respected accelerator program helped Dropbox secure a $1.2 million seed round from prominent angel investors, including Sequoia Capital. Dropbox continued to raise larger rounds of venture capital, eventually going public in 2018 with a valuation of over $12 billion.

Case Study 3: Canva

Canva, the popular graphic design platform, is a more recent example of a successful early-stage startup. Founded in 2012 by Melanie Perkins, Cliff Obrecht, and Cameron Adams, Canva initially bootstrapped the business, focusing on product development and user acquisition. In 2013, the company raised a $3 million seed round from a group of angel investors and venture capitalists, including Matrix Partners and Blackbird Ventures. Over the next few years, Canva continued to raise larger funding rounds, including a $40 million Series A and a $70 million Series B, which allowed the company to expand its team, enhance its product offerings, and solidify its position as a leading player in the design software market.

Step-by-step Guide: Securing Early-stage Startup Funding

Now that you have a better understanding of the early-stage startup funding landscape and the strategies for crafting a winning pitch, let's walk through a step-by-step guide to help you secure the investments your business needs:

Step 1: Determine Your Funding Needs

Start by carefully assessing your startup's financial requirements. Determine how much capital you need to cover your initial expenses, such as product development, hiring, and marketing, as well as the runway you'll require to reach key milestones and demonstrate traction. Clearly define your funding goals, whether it's a specific amount or a range, to help you identify the most suitable funding sources.

Step 2: Research and Evaluate Funding Options

Explore the various funding options available, such as angel investors, venture capitalists, crowdfunding platforms, incubators/accelerators, and government grants. Analyze the pros and cons of each option, considering factors like the investment amounts, the level of involvement from the investors, and the equity or ownership stakes they may require. Identify the funding sources that best align with your startup's stage, industry, and growth objectives.

Step 3: Build Your Investor Network

Networking and building relationships with potential investors is a crucial step in securing early-stage funding. Attend industry events, join relevant online communities, and leverage your personal and professional connections to identify and connect with investors who may be interested in your startup. Engage with these investors, share your story, and demonstrate your passion and commitment to your business.

Step 4: Craft a Compelling Pitch Deck

Develop a polished, visually appealing pitch deck that effectively communicates your startup's value proposition, competitive advantages, traction, and growth plans. Your pitch deck should include key information such as your market opportunity, product or service details, target customer segments, financial projections, and the specific amount of funding you're seeking. Ensure that your pitch deck is tailored to the preferences and investment criteria of your target investors.

Step 5: Prepare for Investor Meetings

Once you've scheduled meetings with potential investors, take the time to thoroughly prepare. Research the investors, understand their investment portfolios and preferences, and anticipate the types of questions they may ask. Practice your pitch repeatedly, refining it based on feedback, and be ready to engage in a thoughtful discussion about your startup's potential and the value it can offer to investors.

Step 6: Follow Up and Negotiate Terms

After your investor meetings, be sure to follow up promptly with any additional information or materials requested. If an investor expresses interest in providing funding, be prepared to negotiate the terms, such as the valuation, equity stake, and any special rights or protections. Seek legal counsel to ensure that the investment terms are fair and aligned with your long-term goals for the business.

Step 7: Maintain Strong Investor Relationships

Securing early-stage funding is just the beginning. Once you've successfully raised capital, it's crucial to maintain strong, ongoing relationships with your investors. Provide them with regular updates on your startup's progress, seek their advice and guidance, and demonstrate your commitment to their continued involvement and support. Nurturing these relationships can open the door to future funding rounds and unlock valuable networking and growth opportunities.

Conclusion

Navigating the world of early-stage startup funding can be a complex and challenging process, but with the right strategies and a well-executed plan, you can successfully secure the investments your business needs to thrive. By understanding the funding landscape, crafting a compelling pitch, and building strong relationships with investors, you'll be well on your way to turning your entrepreneurial dreams into a reality. Remember, securing early-stage funding is just the first step; the real work begins in leveraging those investments to drive your startup's growth and success. Good luck on your funding journey!

KEYWORDS: early-stage startup funding, startup financing, angel investors, venture capitalists, crowdfunding, incubators and accelerators, government grants, pitch deck, investor relations, startup growth

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0