25 Proven Financial Independence Tips to Achieve

25 Proven Financial Independence Tips to Achieve Freedom Financial independence is the holy grail for many people.

25 Proven Financial Independence Tips to Achieve Freedom

Financial independence is the holy grail for many people. The ability to live life on your own terms, without being beholden to a job or a paycheck, is a dream that millions strive for. While the path to financial independence can seem daunting, it is absolutely achievable with the right mindset and strategies.

In this comprehensive guide, we'll explore 25 proven financial independence tips that can help you reach your goals and achieve the freedom you desire. Whether you're just starting your journey or you're well on your way, these tips will provide you with the roadmap and inspiration you need to succeed.

1. Develop a Comprehensive Budget

The foundation of financial independence is a solid budget. Take the time to carefully track your income and expenses, categorizing them in a way that makes sense for your situation. This will give you a clear picture of where your money is going and help you identify areas where you can cut back or optimize your spending.

Start by listing all your fixed expenses, such as rent, mortgage, car payments, and insurance. Then, track your variable expenses, like groceries, dining out, and entertainment. Finally, don't forget to account for irregular expenses, such as car repairs or medical bills.

Once you have a comprehensive budget, review it regularly and make adjustments as needed. This will help you stay on track and ensure that your spending aligns with your financial independence goals.

2. Reduce Expenses and Increase Savings

One of the most effective ways to achieve financial independence is to reduce your expenses and increase your savings. Look for areas where you can cut back, such as dining out, entertainment, or unnecessary subscriptions. Even small savings can add up quickly and contribute to your overall financial independence goals.

For example, let's say you're able to save an extra $200 per month by cutting back on dining out and entertainment. Over the course of a year, that would translate to $2,400 in additional savings. Compound that over several years, and you can see how these small savings can make a big difference in your journey to financial independence.

As you reduce your expenses, be sure to divert those savings directly into your investment accounts or other financial independence-focused initiatives. This will help you build wealth and move closer to your goals.

3. Increase Your Income

While reducing expenses is crucial, increasing your income can also be a powerful driver of financial independence. Look for ways to earn more, whether it's through a side hustle, freelance work, or a promotion at your current job.

Consider your skills and interests, and explore opportunities that align with them. For example, if you're a skilled writer, you could start a freelance writing business. Or if you're passionate about a particular hobby, you could turn it into a profitable side gig.

Remember, even small increases in income can make a big difference over time. By consistently investing a portion of your additional earnings, you can accelerate your path to financial independence.

4. Prioritize Debt Repayment

Debt can be a significant obstacle on the road to financial independence. High-interest debt, such as credit card balances or personal loans, can eat away at your savings and prevent you from making progress towards your goals.

Develop a plan to aggressively pay down your debt, starting with the highest-interest obligations first. Consider strategies like the debt snowball or debt avalanche methods to help you stay focused and motivated.

As you pay off your debt, be sure to redirect those monthly payments towards your savings and investment accounts. This will help you build wealth and move closer to financial independence.

5. Invest Consistently

Investing is a crucial component of financial independence. By consistently investing a portion of your income, you can take advantage of the power of compound interest and grow your wealth over time.

Start by contributing to retirement accounts, such as a 401(k) or IRA, to take advantage of tax-advantaged growth. Then, consider diversifying your investments across a range of asset classes, including stocks, bonds, and real estate.

Remember, investing is a long-term game, and it's important to stay disciplined and consistent. Avoid the temptation to time the market or make impulsive decisions. Instead, focus on building a well-diversified portfolio and letting your investments grow over time.

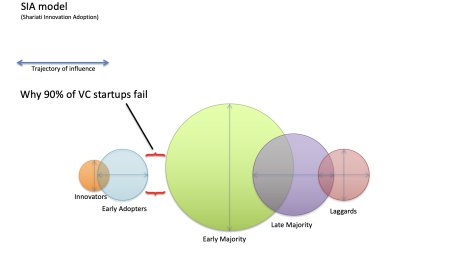

6. Develop Multiple Income Streams

Relying on a single source of income can make it challenging to achieve financial independence. Instead, aim to develop multiple income streams that can provide you with a diversified and reliable source of revenue.

Consider starting a side business, renting out a property, or investing in dividend-paying stocks. These additional income streams can help you build wealth more quickly and provide a safety net in case your primary source of income is disrupted.

As you build your multiple income streams, be sure to reinvest a portion of the earnings back into your investment accounts or other financial independence initiatives. This will help you compound your wealth and move closer to your goals.

7. Embrace Frugality

Frugality is a key component of financial independence. By adopting a frugal mindset and finding creative ways to save money, you can free up more resources to invest towards your goals.

Look for opportunities to reduce your expenses, such as cutting back on unnecessary subscriptions, negotiating bills and services, or finding ways to save on groceries and transportation. Additionally, consider adopting a minimalist lifestyle, where you focus on experiences and relationships rather than material possessions.

Remember, frugality is not about deprivation; it's about prioritizing your spending and aligning it with your values and financial independence objectives.

8. Automate Your Finances

Automating your finances can be a powerful tool in your journey to financial independence. By setting up automatic transfers and payments, you can ensure that your savings and investment contributions are made consistently, without the risk of forgetting or procrastinating.

Start by setting up automatic transfers from your checking account to your savings and investment accounts. This will help you build wealth without having to remember to do it manually each month.

Additionally, consider automating your bill payments to avoid late fees and penalties. This will help you maintain a good credit score and keep your finances organized.

9. Protect Your Assets

As you build wealth and move towards financial independence, it's important to protect your assets from unexpected events or liabilities. This includes having the right insurance coverage, such as life insurance, health insurance, and homeowner's or renter's insurance.

Additionally, consider setting up an emergency fund to cover unexpected expenses, such as medical bills or car repairs. Aim to have at least 3-6 months' worth of living expenses saved in your emergency fund to provide a financial cushion in case of an emergency.

Finally, ensure that you have the appropriate legal documents in place, such as a will, power of attorney, and healthcare directives. This will help protect your assets and ensure that your wishes are carried out in the event of an unexpected circumstance.

10. Embrace Continuous Learning

Financial independence is not a one-time destination; it's a lifelong journey. To stay on track and adapt to changing circumstances, it's important to embrace continuous learning and personal development.

Regularly read books, listen to podcasts, and attend workshops or seminars related to personal finance, investing, and entrepreneurship. Stay up-to-date on the latest trends, strategies, and best practices to ensure that you're making informed decisions and optimizing your path to financial independence.

Additionally, consider seeking out a financial advisor or mentor who can provide personalized guidance and support as you navigate the complexities of your financial situation.

11. Develop a Wealth-Building Mindset

Achieving financial independence requires more than just practical strategies; it also requires a shift in mindset. Develop a wealth-building mindset that focuses on long-term growth, delayed gratification, and a commitment to financial discipline.

This means prioritizing your financial goals over short-term desires, such as impulse purchases or indulgences. It also means cultivating a sense of gratitude and abundance, rather than scarcity or fear.

Remember, financial independence is a journey, and it's important to celebrate your progress and milestones along the way. This will help you stay motivated and focused on your ultimate goals.

12. Invest in Yourself

One of the most valuable investments you can make is in your own personal and professional development. By continuously investing in your skills, knowledge, and well-being, you can increase your earning potential and create more opportunities for financial independence.

Consider taking courses, attending conferences, or pursuing additional education or certifications that can enhance your career or entrepreneurial ventures. Additionally, focus on developing soft skills, such as communication, problem-solving, and leadership, which can be valuable in a wide range of professional settings.

Remember, the more you invest in yourself, the more you can contribute to your financial independence journey and the greater the potential returns on your investment.

13. Embrace Passive Income Streams

Passive income streams are a powerful tool in the pursuit of financial independence. These are sources of revenue that generate income with minimal ongoing effort, allowing you to earn money while you sleep or focus on other priorities.

Some examples of passive income streams include rental properties, dividend-paying stocks, and online businesses or digital products. By diversifying your income sources and creating passive revenue streams, you can reduce your reliance on a single paycheck and accelerate your path to financial independence.

Keep in mind that passive income streams often require an initial investment of time, money, or both. However, the long-term benefits can be significant, as these income sources can continue to generate returns for years to come.

14. Leverage Compound Interest

Compound interest is one of the most powerful tools in the pursuit of financial independence. By consistently investing and reinvesting your earnings, you can harness the power of compound growth to build wealth over time.

The earlier you start investing and saving, the more time your money has to compound and grow. Even small, regular contributions can add up significantly over the course of decades, thanks to the magic of compound interest.

To take full advantage of compound interest, be sure to start investing as early as possible, contribute consistently, and avoid withdrawing your funds prematurely. This will allow your investments to compound and grow, accelerating your path to financial independence.

15. Diversify Your Investments

Diversification is a key principle of successful investing and financial independence. By spreading your investments across a range of asset classes, you can reduce your overall risk and increase the likelihood of achieving your financial goals.

Consider investing in a mix of stocks, bonds, real estate, and alternative assets, such as precious metals or cryptocurrency. This will help you create a well-rounded portfolio that can weather market fluctuations and provide a more stable and consistent return on your investments.

Additionally, diversify within each asset class, such as investing in a variety of sectors, industries, and geographic regions. This will further reduce your exposure to any single investment or market segment.

16. Embrace Minimalism

Minimalism is a lifestyle philosophy that can be a powerful tool in the pursuit of financial independence. By focusing on experiences and relationships rather than material possessions, you can free up resources that can be redirected towards your financial goals.

Start by decluttering your living space and getting rid of items you no longer use or need. This can not only free up physical space but also mental space, allowing you to focus on what truly matters.

Additionally, be mindful of your purchasing decisions and ask yourself whether a new item will truly add value to your life. By adopting a minimalist mindset, you can reduce your expenses, avoid impulse purchases, and allocate more of your resources towards building wealth and achieving financial independence.

17. Optimize Your Taxes

Taxes can be a significant expense, and optimizing your tax strategy can be a crucial component of your financial independence journey. Take the time to understand the various tax-advantaged accounts and strategies available to you, such as 401(k)s, IRAs, and tax-loss harvesting.

Consider working with a qualified tax professional who can help you identify opportunities to minimize your tax burden and ensure that you're taking advantage of all the deductions and credits you're entitled to. This can free up more of your income to invest towards your financial independence goals.

Remember, tax planning is an ongoing process, and it's important to stay up-to-date on changes in tax laws and regulations that may impact your financial situation.

18. Embrace Delayed Gratification

Achieving financial independence often requires a level of delayed gratification and self-discipline. This means resisting the temptation to spend money on immediate desires and instead prioritizing long-term financial goals.

Practice delaying purchases and saving up for larger, more meaningful expenses. This could involve setting aside money each month for a future vacation, a down payment on a home, or a new car. By delaying gratification, you can build up your savings and investments, ultimately accelerating your path to financial independence.

Remember, delayed gratification is a skill that can be developed over time. Start small and celebrate your successes along the way to help reinforce this important habit.

19. Embrace Entrepreneurship

Entrepreneurship can be a powerful path to financial independence. By starting your own business or side hustle, you can create new income streams, increase your earning potential, and gain greater control over your financial future.

Consider your skills, interests, and passions, and explore opportunities to turn them into a profitable venture. This could involve starting an online business, offering freelance services, or creating and selling a product or digital content.

Remember, entrepreneurship comes with its own set of challenges and risks, so be sure to do your research, create a solid business plan, and start small before scaling up. With the right mindset and strategies, however, entrepreneurship can be a transformative step towards financial independence.

20. Invest in Real Estate

Real estate can be a lucrative investment and a key component of a well-rounded financial independence strategy. From rental properties to real estate investment trusts (REITs), there are numerous ways to leverage real estate to build wealth and generate passive income.

When investing in real estate, consider factors such as location, property condition, rental potential, and long-term appreciation. Additionally, explore strategies like house hacking, where you live in one unit of a multi-unit property and rent out the others, or investing in vacation rentals to generate additional income.

Keep in mind that real estate investing requires careful research, planning, and ongoing management. However, the potential rewards, including cash flow, equity growth, and tax benefits, can make it a valuable addition to your financial independence portfolio.

21. Optimize Your Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs, are powerful tools for building wealth and achieving financial independence. By maximizing your contributions to these tax-advantaged accounts, you can accelerate your savings and take advantage of the power of compound interest.

Start by contributing at least enough to your employer-sponsored 401(k) to receive any matching contributions, as this is essentially free money that can supercharge your savings. Then, consider opening and contributing to a Roth IRA or traditional IRA, depending on your individual circumstances and tax situation.

Remember to review and adjust your retirement account allocations regularly to ensure that your investments are aligned with your risk tolerance and financial independence goals.

22. Cultivate Patience and Persistence

Achieving financial independence is not a quick or easy process; it requires patience, persistence, and a long-term mindset. There will be ups and downs, setbacks and challenges, but it's important to stay the course and remain committed to your goals.

Celebrate your small wins and milestones along the way, and don't get discouraged by temporary setbacks. Remember that the journey to financial independence is

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0