Personal Budgeting Templates: Your Ultimate Guide to

Personal Budgeting Templates: Your Ultimate Guide to Effective Money Management In today's fast-paced world, managing your personal finances can be

Personal Budgeting Templates: Your Ultimate Guide to Effective Money Management

In today's fast-paced world, managing your personal finances can be a daunting task. From keeping track of expenses to planning for future goals, the complexities of money management can quickly become overwhelming. However, with the right tools and strategies, you can take control of your financial future. One such powerful tool is the personal budgeting template.

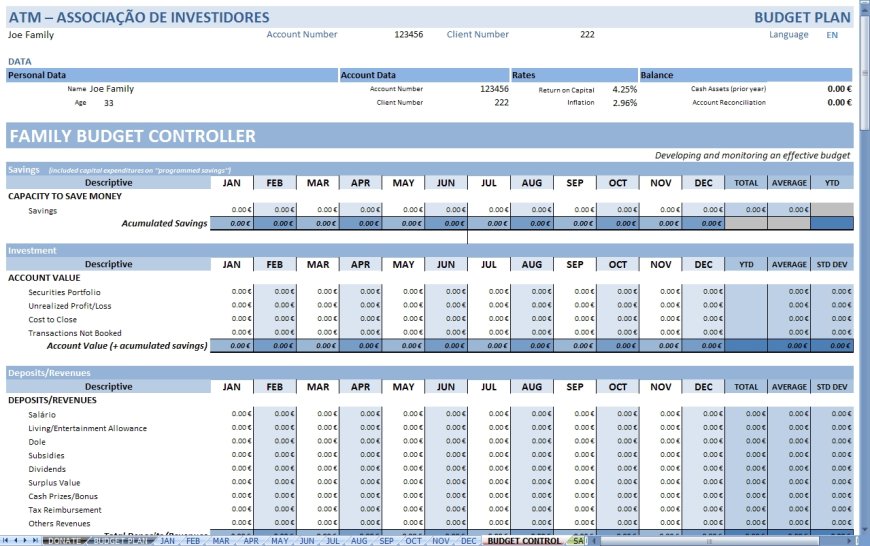

Personal budgeting templates are pre-designed spreadsheets or documents that provide a structured framework for organizing and tracking your income, expenses, savings, and investments. These templates are designed to make the process of budgeting more efficient, effective, and user-friendly. Whether you're a seasoned financial planner or just starting to take control of your finances, personal budgeting templates can be a game-changer in your journey towards financial stability and success.

The Benefits of Using Personal Budgeting Templates

Adopting a personal budgeting template can bring a multitude of benefits to your financial well-being. Here are some of the key advantages:

1. Improved Visibility and Control

Personal budgeting templates provide a clear and comprehensive view of your financial situation. By organizing your income, expenses, and spending patterns in a structured format, you gain better visibility into where your money is going. This increased transparency allows you to make more informed decisions and gain a greater sense of control over your finances.

2. Effective Expense Tracking

One of the primary functions of a personal budgeting template is to help you track your expenses. By categorizing and recording your spending, you can identify areas where you may be overspending and make adjustments accordingly. This level of detail can be instrumental in identifying opportunities for cost savings and better aligning your spending with your financial goals.

3. Goal-Setting and Monitoring

Personal budgeting templates often include features for setting financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. By incorporating these goals into your template, you can track your progress and ensure that your spending and saving habits are aligned with your long-term objectives.

4. Improved Budgeting Discipline

The structure and organization provided by a personal budgeting template can help cultivate better budgeting habits and discipline. By regularly updating your template and reviewing your financial data, you develop a routine that reinforces responsible money management practices.

5. Reduced Stress and Increased Financial Confidence

Gaining a clear understanding of your financial situation and having a plan in place can significantly reduce the stress and anxiety often associated with personal finance. As you become more proficient in using your personal budgeting template, you'll experience a growing sense of financial confidence and empowerment.

Common Mistakes to Avoid When Using Personal Budgeting Templates

While personal budgeting templates can be incredibly useful, there are some common mistakes that people often make when using them. Recognizing and avoiding these pitfalls can help you maximize the effectiveness of your budgeting efforts.

1. Failing to Customize the Template

One-size-fits-all templates may not always align with your unique financial situation and needs. It's essential to take the time to customize your personal budgeting template to reflect your specific income sources, expense categories, and financial goals. This personalization will ensure that the template is truly tailored to your individual circumstances.

2. Neglecting to Update the Template Regularly

Budgeting is an ongoing process, and your personal budgeting template should be updated regularly to reflect changes in your financial situation. Failing to keep your template up-to-date can lead to inaccurate data and undermine the effectiveness of your budgeting efforts.

3. Overlooking Irregular or Unexpected Expenses

While it's important to account for your regular, predictable expenses, it's equally crucial to plan for irregular or unexpected costs, such as medical bills, car repairs, or home maintenance. Incorporating these types of expenses into your personal budgeting template can help you avoid financial surprises and ensure that your budget remains realistic and comprehensive.

4. Unrealistic Goal-Setting

When setting financial goals within your personal budgeting template, it's essential to ensure that they are achievable and aligned with your current financial capabilities. Overly ambitious or unrealistic goals can lead to frustration and a sense of failure, undermining the effectiveness of your budgeting efforts.

5. Failing to Review and Adjust the Template

Your financial situation is likely to change over time, and your personal budgeting template should evolve accordingly. Regularly reviewing your template and making necessary adjustments can help you adapt to new circumstances and ensure that your budgeting strategies remain relevant and effective.

Types of Personal Budgeting Templates

There are various types of personal budgeting templates available, each with its own unique features and benefits. Here are some of the most common types:

1. Spreadsheet-Based Templates

Spreadsheet-based personal budgeting templates, such as those created in Microsoft Excel or Google Sheets, offer a high degree of customization and flexibility. These templates typically include features like income and expense tracking, goal-setting, and reporting capabilities. They are well-suited for individuals who prefer a more hands-on approach to budgeting and financial management.

2. App-Based Templates

In the digital age, there are numerous mobile applications and web-based tools that provide personal budgeting templates. These templates often integrate with your bank accounts and credit cards, automatically importing and categorizing your transactions. This can save time and effort, making it easier to maintain an accurate and up-to-date budget.

3. Printable Templates

For those who prefer a more traditional approach, printable personal budgeting templates can be a great option. These templates are typically designed to be printed and used as physical documents, allowing you to manually record your income, expenses, and financial activities. Printable templates can be particularly useful for individuals who prefer a hands-on, paper-based budgeting experience.

4. Template Bundles

Some personal budgeting template providers offer comprehensive bundles that include multiple templates for various financial aspects, such as monthly budgets, debt tracking, savings plans, and net worth statements. These bundled templates can provide a more holistic approach to personal finance management, helping you streamline your budgeting and planning processes.

Case Studies: Real-Life Examples of Successful Personal Budgeting

Case Study 1: The Smith Family

The Smith family, consisting of John, Sarah, and their two children, had always struggled with managing their finances. They often found themselves living paycheck to paycheck and unable to save for their long-term goals. After attending a personal finance workshop, they decided to implement a personal budgeting template to gain better control over their money.

The Smiths chose a comprehensive spreadsheet-based template that allowed them to track their income, categorize their expenses, and set specific financial goals. They spent time customizing the template to reflect their unique situation, including their monthly mortgage payments, childcare costs, and irregular expenses like car repairs and medical bills.

By consistently updating the template and reviewing their spending patterns, the Smiths were able to identify areas where they could cut back on expenses. They made adjustments to their discretionary spending, such as dining out and entertainment, and redirected those funds towards their savings goals. Over the course of a year, the Smiths were able to build a substantial emergency fund and make significant progress towards paying off their credit card debt.

The Smiths attribute their newfound financial stability and progress towards their goals to the personal budgeting template, which provided them with the structure and discipline needed to manage their money effectively.

Case Study 2: Jessica's Debt Payoff Journey

Jessica, a recent college graduate, found herself saddled with a significant amount of student loan debt. Determined to take control of her financial future, she decided to implement a personal budgeting template to help her develop a strategic debt payoff plan.

Jessica chose an app-based personal budgeting template that allowed her to connect her bank accounts and credit cards, automatically categorizing her transactions and providing real-time insights into her spending. She customized the template to include her monthly income, fixed expenses (such as rent and utilities), and her various student loan payments.

By closely monitoring her spending and consistently updating the template, Jessica was able to identify areas where she could cut back on discretionary expenses, such as dining out and entertainment. She redirected those savings towards her student loan payments, making additional lump-sum payments whenever possible.

Over the course of two years, Jessica's diligent use of the personal budgeting template allowed her to pay off her entire student loan balance. The template's goal-tracking features kept her motivated and focused, and the automatic transaction categorization made it easier for her to maintain an accurate and up-to-date budget.

Jessica's success story showcases the power of personal budgeting templates in helping individuals achieve their financial goals, even in the face of significant debt challenges.

Step-by-Step Guide to Creating and Utilizing a Personal Budgeting Template

Creating and effectively using a personal budgeting template can be a transformative experience for your financial well-being. Here's a step-by-step guide to help you get started:

Step 1: Assess Your Current Financial Situation

Begin by gathering all the necessary information about your income, expenses, assets, and liabilities. This may include pay stubs, bank statements, credit card statements, and any other relevant financial documents.

Step 2: Choose a Personal Budgeting Template

Decide on the type of personal budgeting template that best suits your needs and preferences. Consider factors such as your level of financial expertise, the level of customization you require, and whether you prefer a digital or paper-based approach.

Step 3: Customize the Template

Once you've selected a template, take the time to customize it to reflect your unique financial situation. This may involve adding or modifying expense categories, adjusting income sources, and incorporating your specific financial goals.

Step 4: Input Your Financial Data

Carefully input all your income, expense, and financial data into the personal budgeting template. Ensure that the information is accurate and up-to-date to maintain the integrity of your budget.

Step 5: Analyze and Categorize Your Spending

Review your expenses and categorize them into relevant groups, such as housing, transportation, food, utilities, and discretionary spending. This will help you identify areas where you can potentially reduce or optimize your spending.

Step 6: Set Financial Goals

Utilize the goal-setting features of your personal budgeting template to establish clear, achievable financial objectives, such as saving for an emergency fund, paying off debt, or investing for retirement.

Step 7: Monitor and Adjust Your Budget

Regularly review and update your personal budgeting template to ensure that it remains accurate and aligned with your changing financial circumstances. Be prepared to make adjustments to your spending, savings, and goals as needed.

Step 8: Stick to Your Budget

The key to success with a personal budgeting template is consistency. Make a habit of regularly updating your template and using it as a guide for your financial decision-making. Celebrate your progress and stay motivated by tracking your achievements.

Conclusion

Personal budgeting templates are powerful tools that can transform the way you manage your finances. By providing a structured and customizable framework for organizing your income, expenses, and financial goals, these templates can help you gain greater visibility and control over your money, reduce financial stress, and achieve your long-term financial objectives.

Whether you choose a spreadsheet-based, app-based, or printable personal budgeting template, the key is to find a solution that aligns with your unique needs and preferences. By avoiding common mistakes and following a step-by-step approach to implementation, you can unlock the full potential of personal budgeting templates and embark on a journey towards financial stability and success.

Embrace the power of personal budgeting templates and take the first step towards a more financially secure future. Start today and experience the life-changing benefits of effective money management.

KEYWORDS: personal budgeting templates, budgeting, personal finance, money management, financial planning, expense tracking, goal-setting, debt payoff, savings, spreadsheet templates, app-based templates, printable templates

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0