Mastering Cash Flow Forecasting: A Comprehensive Guide

Introduction to Cash Flow ForecastingCash flow forecasting is a critical financial management tool that helps businesses of all sizes plan,

Introduction to Cash Flow Forecasting

Cash flow forecasting is a critical financial management tool that helps businesses of all sizes plan, monitor, and optimize their financial resources. By accurately predicting future cash inflows and outflows, companies can make informed decisions, identify potential cash shortages, and ensure long-term financial stability. In this comprehensive guide, we'll explore the importance of cash flow forecasting, the challenges businesses face, and the step-by-step strategies to implement an effective cash flow forecasting system.

The Importance of Cash Flow Forecasting

Cash flow is the lifeblood of any business, and understanding its ebb and flow is essential for financial success. Cash flow forecasting allows you to anticipate and manage your company's financial resources, enabling you to make informed decisions, seize opportunities, and mitigate risks. By accurately forecasting your cash flow, you can:

- Identify and address potential cash shortages: Proactively identifying cash flow gaps helps you take corrective action, such as securing additional financing or adjusting your spending, to ensure your business has the necessary funds to meet its obligations.

- Optimize working capital management: Cash flow forecasting allows you to better manage your inventory, accounts receivable, and accounts payable, ensuring that your working capital is used efficiently and effectively.

- Inform strategic decision-making: With a clear understanding of your future cash flow, you can make more informed decisions about investments, expansion plans, and other strategic initiatives that can impact your business's financial health.

- Secure financing and manage relationships with lenders: Accurate cash flow forecasts can help you secure financing, negotiate better terms with lenders, and demonstrate your business's financial stability and creditworthiness.

- Improve budgeting and planning: Cash flow forecasting is a crucial component of effective budgeting and financial planning, allowing you to align your spending and investments with your projected cash inflows and outflows.

Challenges in Cash Flow Forecasting

While the benefits of cash flow forecasting are clear, businesses often face several challenges in implementing and maintaining an effective forecasting system. Some of the common challenges include:

1. Unpredictable Revenue Streams

Many businesses, especially those in industries with seasonal fluctuations or irregular sales patterns, struggle to accurately predict their future cash inflows. Unexpected changes in customer demand, market conditions, or client payment behavior can significantly impact revenue and make cash flow forecasting more challenging.

2. Difficulty Estimating Expenses

Accurately estimating future expenses, such as operating costs, inventory purchases, and debt service payments, can be challenging, particularly for growing or rapidly changing businesses. Unexpected expenses, such as equipment breakdowns or regulatory changes, can further complicate the forecasting process.

3. Lack of Historical Data

Businesses, especially startups or those undergoing significant changes, may have limited historical financial data, making it difficult to establish reliable forecasting models and identify patterns in cash flow. This lack of data can lead to inaccurate projections and increased uncertainty.

4. Complexity of Cash Flow Dynamics

Cash flow is influenced by a multitude of factors, including sales cycles, payment terms, inventory management, and financing arrangements. Capturing the nuances and interdependencies of these various elements can be a significant challenge, particularly for businesses with complex operations or multiple revenue streams.

5. Resistance to Change

Implementing a robust cash flow forecasting system may require changes to existing financial processes, reporting structures, and organizational culture. Overcoming resistance to change and ensuring buy-in from key stakeholders can be a significant hurdle for some businesses.

Comprehensive Solution: Effective Cash Flow Forecasting

To overcome the challenges and unlock the full potential of cash flow forecasting, businesses can follow a comprehensive, step-by-step approach:

1. Establish a Cash Flow Forecasting Framework

Begin by defining the scope and objectives of your cash flow forecasting efforts. Determine the time horizon (e.g., weekly, monthly, quarterly) that aligns with your business needs and decision-making processes. Identify the key data sources, such as sales records, accounts receivable, accounts payable, and capital expenditures, that will feed into your forecasting model.

2. Gather and Organize Financial Data

Collect and organize your historical financial data, including past cash inflows and outflows, to establish a solid foundation for your forecasting model. Ensure that your data is accurate, consistent, and readily accessible, as this will be the backbone of your cash flow projections.

3. Develop Forecasting Methodologies

Choose the appropriate forecasting methodologies based on your business needs and the availability of historical data. Common approaches include trend analysis, regression modeling, and scenario-based forecasting. Experiment with different techniques to determine the most accurate and reliable method for your specific business.

4. Incorporate Key Assumptions and Variables

Identify the critical assumptions and variables that can impact your cash flow, such as sales growth rates, payment terms, inventory levels, and financing arrangements. Incorporate these elements into your forecasting model, and regularly review and update them as your business and market conditions evolve.

5. Automate and Integrate Forecasting Processes

Leverage technology and software solutions to automate your cash flow forecasting processes, reducing manual effort and improving accuracy. Integrate your forecasting system with your accounting software, enterprise resource planning (ERP) system, or other relevant business applications to ensure seamless data flow and real-time updates.

6. Regularly Monitor and Adjust Forecasts

Continuously monitor your cash flow forecasts, comparing them to actual results and making adjustments as necessary. Regularly review your assumptions, identify variances, and implement corrective actions to ensure your forecasts remain accurate and relevant.

7. Communicate and Collaborate

Effective cash flow forecasting requires cross-functional collaboration and communication. Share your forecasts with key stakeholders, such as finance, operations, and executive teams, to align decision-making and ensure everyone is working towards the same financial objectives.

Implementing Cash Flow Forecasting: A Step-by-Step Guide

To help you get started with cash flow forecasting, here's a step-by-step guide:

Step 1: Gather Historical Financial Data

Collect and organize your past financial records, including income statements, balance sheets, and cash flow statements. This data will serve as the foundation for your forecasting model.

Step 2: Identify Key Cash Flow Drivers

Analyze your historical data to determine the primary factors that influence your cash inflows and outflows, such as sales cycles, payment terms, inventory management, and capital expenditures.

Step 3: Develop Forecasting Assumptions

Based on your analysis, create a set of assumptions about future sales, expenses, and other relevant variables. These assumptions should be realistic and grounded in market trends, industry benchmarks, and your own business strategy.

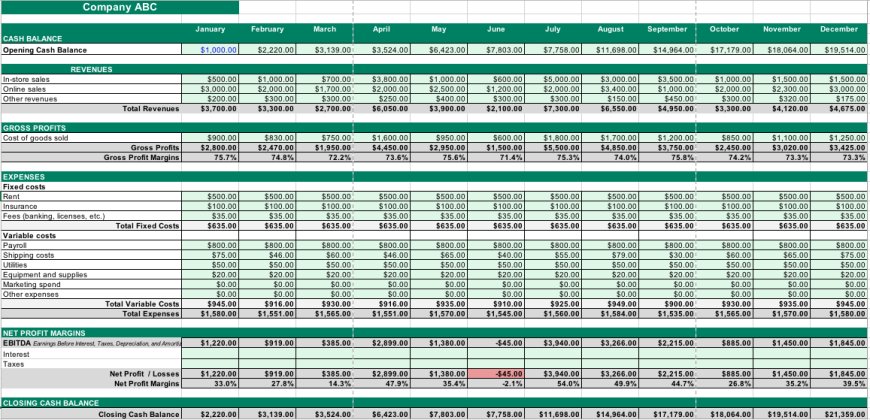

Step 4: Create a Cash Flow Forecast

Using your historical data and forecasting assumptions, build a cash flow projection model, typically in the form of a spreadsheet. This model should include detailed line items for cash inflows (e.g., sales, collections) and cash outflows (e.g., expenses, capital expenditures, debt service).

Step 5: Analyze and Refine the Forecast

Regularly review your cash flow forecast, comparing it to actual results and making adjustments as needed. Identify any variances or discrepancies, and investigate the underlying causes to improve the accuracy of your future projections.

Step 6: Integrate with Business Planning

Incorporate your cash flow forecast into your overall business planning and decision-making processes. Use the insights gained from your forecasting to inform strategic decisions, such as investments, financing, and resource allocation.

Step 7: Automate and Streamline the Process

Leverage technology and software solutions to automate your cash flow forecasting, reducing manual effort and improving efficiency. Integrate your forecasting system with your accounting software, ERP, or other relevant business applications to ensure seamless data flow and real-time updates.

Real-World Examples and Case Studies

To illustrate the practical application of cash flow forecasting, let's consider a few real-world examples:

Example 1: Seasonal Retail Business

A seasonal clothing retailer experiences significant fluctuations in sales and cash flow throughout the year, with peak demand during the holiday season. By implementing a comprehensive cash flow forecasting system, the retailer was able to anticipate and manage its working capital needs more effectively. This allowed the business to secure favorable financing terms, optimize inventory levels, and ensure sufficient cash reserves to cover its peak season expenses.

Example 2: Rapidly Growing Tech Startup

A fast-growing tech startup faced challenges in accurately forecasting its cash flow due to rapid changes in customer acquisition, product development, and hiring. By developing a detailed, scenario-based cash flow forecasting model, the startup was able to identify potential cash shortages, secure additional funding, and make informed decisions about its expansion plans. This proactive approach helped the startup maintain financial stability and continue its growth trajectory.

Example 3: Diversified Manufacturing Company

A diversified manufacturing company with multiple product lines and revenue streams struggled to manage its cash flow due to the complexity of its operations. By implementing an integrated cash flow forecasting system that incorporated data from its ERP, accounting, and sales systems, the company was able to gain a comprehensive view of its financial position. This enabled the company to optimize its working capital, negotiate better terms with suppliers, and make strategic decisions about capital investments and acquisitions.

Troubleshooting and Common Mistakes

While cash flow forecasting can be a powerful tool, businesses may encounter various challenges and pitfalls along the way. Here are some common mistakes to avoid and strategies for troubleshooting:

1. Inaccurate Data Input

Ensure that the financial data you're using in your forecasting model is accurate, up-to-date, and consistent. Regularly reconcile your records and cross-check your inputs to minimize the risk of errors.

2. Unrealistic Assumptions

Carefully review your forecasting assumptions and ensure they are grounded in market trends, industry benchmarks, and your own historical performance. Avoid overly optimistic or pessimistic projections, and regularly update your assumptions as conditions change.

3. Lack of Sensitivity Analysis

Incorporate sensitivity analysis into your forecasting model to understand the impact of potential changes in key variables, such as sales, expenses, or interest rates. This will help you identify and address potential risks and develop contingency plans.

4. Insufficient Monitoring and Adjustment

Regularly review your cash flow forecasts, compare them to actual results, and make necessary adjustments to your model. Failing to monitor and update your forecasts can lead to inaccurate projections and poor decision-making.

5. Siloed Approach

Effective cash flow forecasting requires cross-functional collaboration and communication. Ensure that your forecasting process involves key stakeholders from finance, operations, sales, and other relevant departments to capture a comprehensive view of your business.

Future Trends and Industry Insights

As businesses continue to navigate the ever-evolving financial landscape, the role of cash flow forecasting is expected to become increasingly crucial. Here are some emerging trends and industry insights to consider:

1. Adoption of Advanced Analytics and AI

The integration of advanced analytics, machine learning, and artificial intelligence (AI) into cash flow forecasting will enable businesses to make more accurate and data-driven projections. These technologies can help identify patterns, detect anomalies, and generate more sophisticated forecasting models.

2. Increased Focus on Scenario Planning

Businesses will place greater emphasis on scenario-based cash flow forecasting, allowing them to anticipate and prepare for a range of potential market conditions, economic shifts, and disruptive events. This approach will help organizations become more resilient and agile in their financial decision-making.

3. Integration with Enterprise-Wide Systems

Cash flow forecasting will become more deeply integrated with enterprise-wide systems, such as ERP, CRM, and supply chain management platforms. This integration will provide a more holistic view of the business, enabling real-time data-sharing and more accurate, responsive forecasting.

4. Emphasis on Sustainability and ESG Factors

As environmental, social, and governance (ESG) considerations become increasingly important, businesses will need to incorporate these factors into their cash flow forecasting models. This will help organizations better understand the financial implications of their sustainability initiatives and make more informed decisions.

5. Increased Regulatory Scrutiny

Regulatory bodies and financial institutions will likely place greater emphasis on the quality and transparency of cash flow forecasting, particularly in industries with high financial risk or public scrutiny. Businesses will need to ensure their forecasting practices meet evolving compliance standards and reporting requirements.

Conclusion: Mastering Cash Flow Forecasting for Business Success

Cash flow forecasting is a critical financial management tool that can help businesses of all sizes achieve greater financial stability, optimize their operations, and make more informed strategic decisions. By overcoming the challenges, implementing a comprehensive forecasting framework, and staying ahead of industry trends, organizations can unlock the full potential of cash flow forecasting and position themselves for long-term success.

Remember, effective cash flow forecasting is an ongoing process that requires continuous monitoring, adjustment, and collaboration. By embracing this practice and making it a core part of your financial management strategy, you can navigate the complexities of the business landscape with confidence and achieve your financial goals.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0